straight life policy term

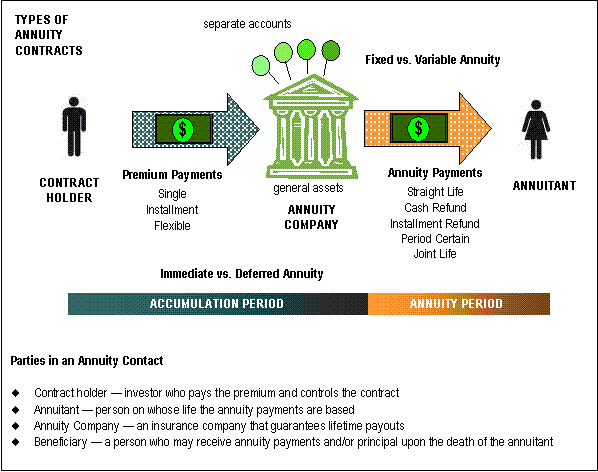

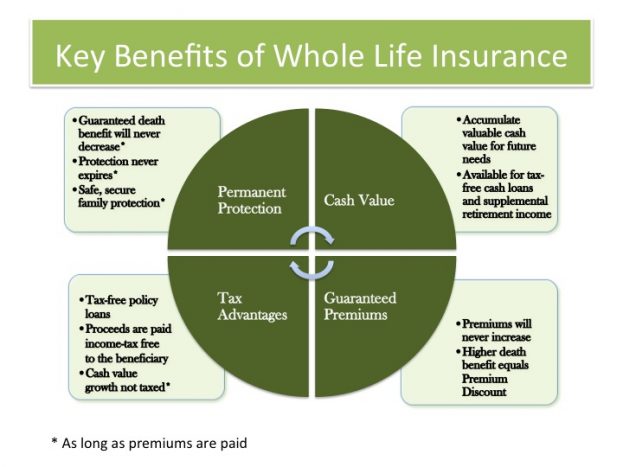

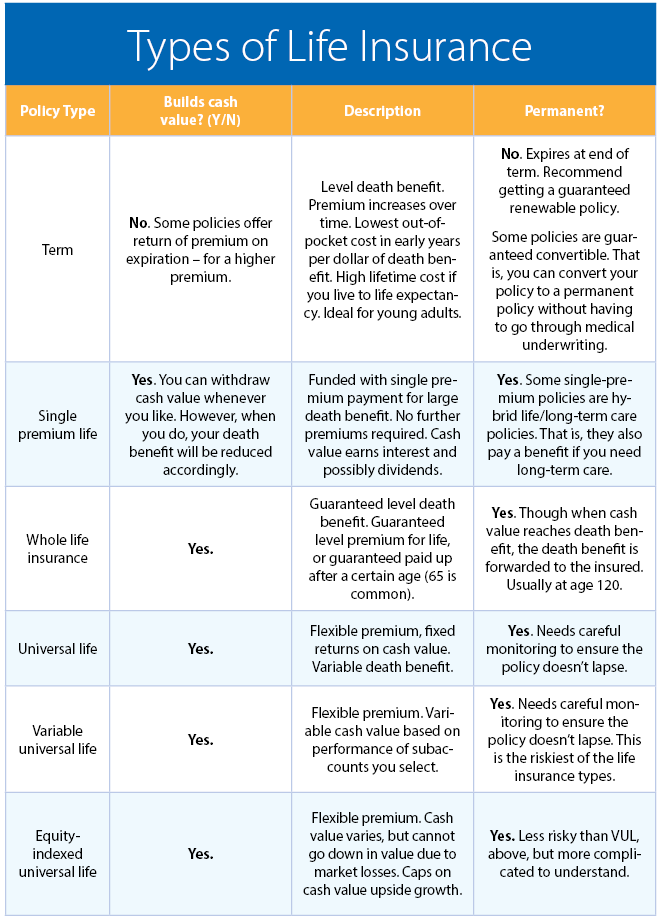

Whole life insurance is a type of life insurance that provides coverage for the entirety of the policyholders life and has a savings component. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or.

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Difference between straight life insurance vs.

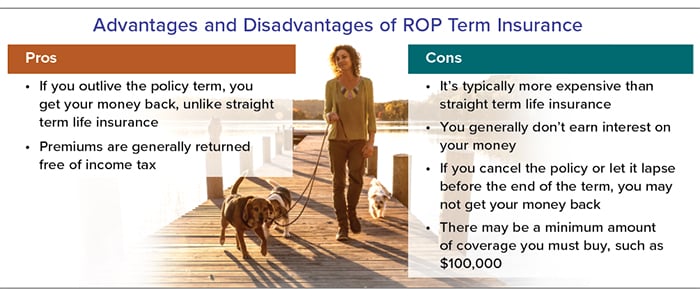

. Another name for a straight term policy is renewable return-of-premium term policy. It is also known as whole life insurance. The type of life policy he is looking for is called a.

Study with Quizlet and memorize flashcards containing terms like What type of life insurance policy covers two or more persons and pays the face amount upon the death of the first. As an individual ages their cost of insurance rises. A life insurance policy that provides coverage only for a certain period of time.

12222 Merit Drive Suite 1600 Dallas TX 75251-2266 972 960-7693 800 827-4242. A straight term insurance policy provides a benefit upon the death of the policyholder but ceases to provide. International Risk Management Institute Inc.

Term life insurance death benefit amount Monthly premium for a 30-year-old male Monthly premium for a 30-year-old female. It pays out a death benefit. B Family income policy.

While straight life insurance offers lifelong coverage term life insurance provides temporary life insurance coverage. C Survivorship life policy. A Joint life policy.

A Joint life policy. Most term life insurance policies offer a level death benefit and premiums. What is another name for straight term policy.

A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit. Straight life insurance policies are designed for those looking for protection guaranteed cash value growth.

This traditional life insurance is sometimes also known as. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit. What does the term whole life mean.

Premiums to purchase all forms of life insurance are based on mortality tables. Straight whole life insurance require more premium than. D Modified endowment contract.

A straight life insurance policy provides coverage for a lifetime with constant premiums throughout the policys term.

Whole Life Insurance Provide Security For Your Family

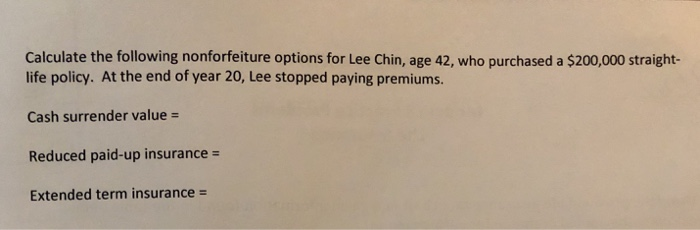

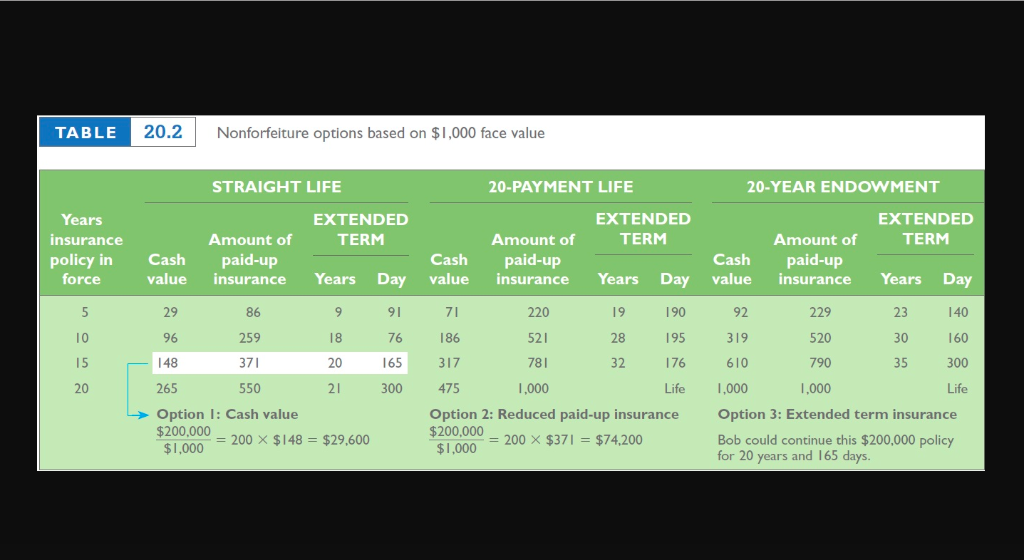

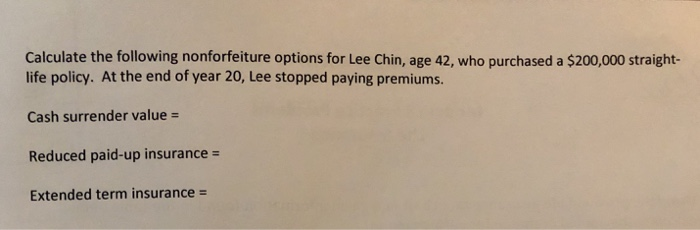

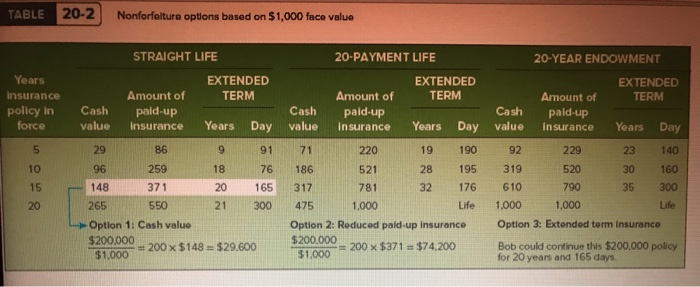

Solved Calculate The Cash Surrender Value For Lee Chin Age Chegg Com

What Is A Straight Life Annuity Everything You Need To Know

Solved Calculate The Following Nonforfeiture Options For Lee Chegg Com

What Are The Principal Types Of Life Insurance Iii

What Is A Straight Life Policy Bankrate

Straight Life Insurance New York Life

Understanding Life Insurance What Policy Type Is Best For You

Return Of Premium Life Insurance Protection And Cash Back Annuityadvantage

Solved Calculate The Reduced Paid Up Insurance For Lee Chin Chegg Com

What Is A Ppo Preferred Provider Organization Part 2 Types Of Health Insurance Health Insurance Plans Dental Insurance Plans

Johnathon Davis Johnath87228771 Twitter

Straight Life Insurance New York Life

Term Insurance Vs Permanent Cash Value Insurance Empyrion Wealth Management

What Is The Difference Between Term And Whole Life Insurance

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-V3-1e8001745dae43aeaa892c04e25d46b1.png)